Protocol mechanics

How it works

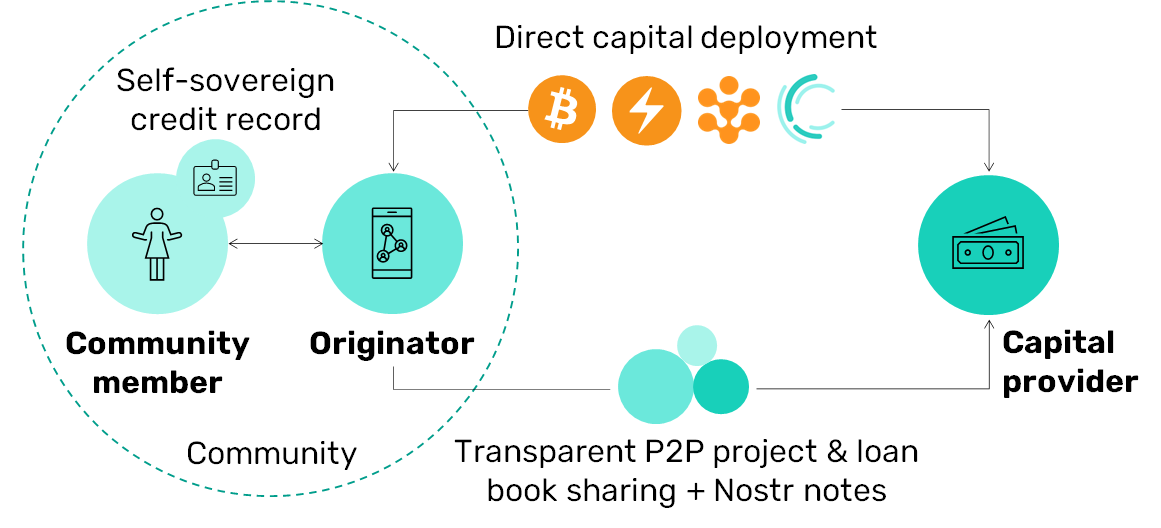

The following diagram provides a high-level overview of the Growr protocol.

Originators manage the “last-mile” processes through their Growr node. They help community members to build their self-sovereign credit record and facilitate access to the protocol services & project funding for them.

Capital providers fund projects either by accessing the Growr node of an originator directly; or by running their own node and using the protocol discoverability features. The P2P data exchange enables real-time reporting of the project portfolio for full transparency.

Lending

The diagram below presents a summary of the lending processes.

- The borrower is onboarded on a platform, provided by an originator (such as a cooperative, guild, wholesale buyer, digital wallet, or another provider), where the borrower defines their funding needs.

- One or more trusted parties, such as merchants of suppliers, provide credentials to the borrower to start building their self-sovereign credit record.

- The originator creates a loan offer in the form of a project with details about the local activities and the financing needs of the borrowers.

- Borrowers go through a simple application process to receive a loan after asserting their eligibility with their verifiable credentials.

- The disbursed amount is received by the borrowers in the borrowing application or directly paid to a third party, such as a merchant or a supplier.

- The third party provides the necessary goods and services to the borrower to achieve their goals.

- Depending on their business activity and the agreed lending conditions, the borrowers repay their loans on a regular basis or as a bullet payment at the end of the season.

Funding

The diagram below presents a summary of the funding processes.

- While creating the loan offer, the originator defines the project funding terms and available payment rails.

- A capital provider reviews the projects with their predefined eligibility criteria and funding parameters, assesses the risk and confirms his investment intent.

- The capital provider deploys funding to the project as a senior tranche via any of the possible payment rails.

- The originator utilizes the provided capital and performs the actual lending activity to the borrowers.

- The capital provider monitors the performance of their investment through Growr protocol that provides reporting of real-time events and full transparency into how the capital is deployed into borrower subscriptions.

- According to the agreed funding terms, the originator repays back the senior tranche plus the generated yield.

Protocol participants

Borrowers

Borrowers, represented by self-employed, micro-businesses, and smallholder farmers, apply for productive loans from the marketplace, most often with the help of a local originator, and then repay the loan plus its price.

Originators

Originators facilitate access to the protocol by grouping several borrowers with similar needs and presenting project applications to the marketplace on their behalf. They publish offers to the loan marketplace by creating projects on behalf of the borrowers. The originators provide junior (first-loss) capital to finance the whole project or part of it. They can be:

- Local cooperatives, guilds or other community organizations formed by borrowers to gain better access to loans and to standardize their relationship with the rest of the participants in the ecosystem.

- Bitcoin circular economies using solutions such as Federated Chaumian mints [20], enabling access to micro-financing to their users.

- Telcos, retailers and gig-economy platforms that onboard and vet the users into their services and then facilitate their access to the protocol as an embedded financial service.

- Digital wallets and fintech providers that already offer financial services and that can expand to unsecured decentralized lending.

Trusted parties

Trusted parties assert facts about the borrowers in the form of verifiable credentials. They can be:

- The originator, issuing credentials for its members or users.

- Merchants, buyers, unions, chambers or other local organizations that serve the community or have knowledge of their members.

- Independent third-party data providers that can issue credentials related to the activity of the borrower and relevant to the risk assessment process, such as KYC/AML, account data, and on-chain activity.

- Financial health providers that publish educational materials and tools to help borrowers develop good financial habits and issue credentials that assert knowledge, skills, and accomplishments.

Capital providers

Capital providers allocate senior capital to the loan marketplace and delegate the actual lending activity to the originators in the form of senior tranches for the financed projects. They can be:

- Individual Bitcoin investors.

- Large institutional investors or digital asset managers.

- Decentralized finance protocols.

Growr protocol

Growr protocol implements a global decentralized micro-lending marketplace as a P2P network of Growr nodes. Each Growr node represents a package of open-source components and a set of lending projects. It enables originators to publish projects with predefined conditions and eligibility criteria, and borrowers to apply and get financing using credentials from their self-sovereign credit record. It also enables capital providers to fund projects either by accessing the Growr node of an originator directly; or by running their own node.

Participant incentives

| Role | Tangible incentives | Intangible incentives |

| Borrower | Access to productive capital at a fair price. Optional “cash-back”-like rewards paid by the originator for positive behavior (e.g., on-time repayment). Opportunity to start saving in bitcoin (optional). | Build their self-sovereign credit record with the ability to use it for future financing needs. |

| Trusted party | One-time fee paid by the borrower upon VC issuing (optional). Financial health rewards paid by the originator after on-time loan repayment (optional). | Success and growth of the community. |

| Originator | Origination fee upon each loan disbursement. Interest margin (yield) from the borrowers. Access to global capital without intermediaries. | Success and growth of the community. Revenue growth for service providers. Access to more customers in the marketplace. |

| Capital provider | Real-world yield on the invested capital. Return on digital assets without selling them. | End-to-end transparency for the investments without intermediary counterparty risk. Bringing impact to local communities. |

| Growr node | Protocol fee for loan management infrastructure. Capital routing and exchange fees (optional). |